Understanding wealth and how to maximize it is an essential part of financial planning. Aagmaal serves as a guiding light, offering insights into the complexities of wealth management. Whether you're a beginner or an experienced investor, aagmaal provides the tools and knowledge to help you achieve financial success. In this comprehensive guide, we will delve into the world of wealth maximization, uncovering strategies and tips to help you secure your financial future.

Wealth is not just about earning money; it's about understanding how to grow and preserve it. With the right mindset and tools, you can create a solid foundation for financial independence. Aagmaal is designed to provide you with actionable advice and expert strategies to help you navigate the financial landscape.

This guide is packed with insights, practical tips, and expert advice to help you maximize your wealth. By the end of this article, you'll have a clear understanding of how aagmaal can transform your financial journey and set you on the path to prosperity.

Read also:Kannada Movierulz A Comprehensive Guide To Navigating The World Of South Indian Cinema

Table of Contents

- What is Aagmaal?

- Importance of Wealth Maximization

- Key Principles of Aagmaal

- Strategies for Growing Wealth

- Common Mistakes to Avoid

- Tools and Resources for Aagmaal

- How to Start Aagmaal

- Measuring Success in Aagmaal

- Expert Advice for Aagmaal

- Conclusion

What is Aagmaal?

Aagmaal refers to the comprehensive approach to understanding and maximizing wealth. It involves a strategic combination of saving, investing, and managing financial resources to achieve long-term financial goals. Aagmaal is not just a financial plan; it’s a lifestyle that emphasizes financial literacy and prudent decision-making.

History of Aagmaal

The concept of aagmaal has evolved over the years, influenced by ancient principles of wealth management and modern financial practices. From the teachings of ancient philosophers to the strategies of contemporary financial experts, aagmaal incorporates a wide range of knowledge to help individuals achieve financial success.

Core Components of Aagmaal

Aagmaal consists of several core components that work together to create a robust financial strategy:

- Saving: Building a financial safety net through regular savings.

- Investing: Growing wealth through smart investment decisions.

- Managing Debt: Controlling and reducing debt to improve financial health.

- Planning for Retirement: Ensuring financial security in later years.

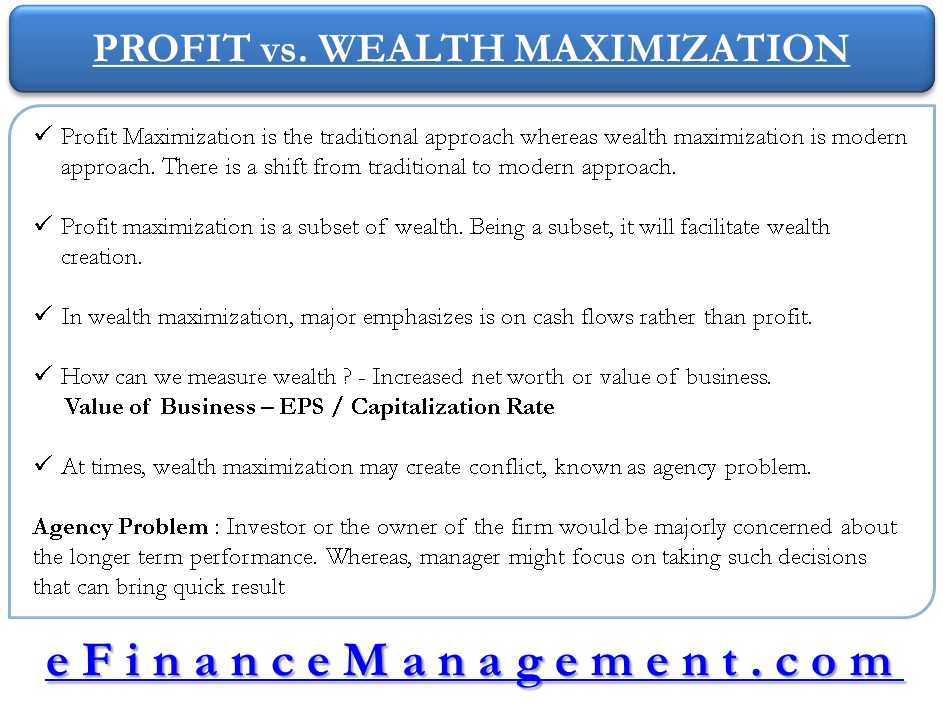

Importance of Wealth Maximization

Wealth maximization is crucial for achieving financial independence and securing your future. By maximizing your wealth, you can:

- Reduce financial stress and uncertainty.

- Enhance your quality of life.

- Provide for your family and future generations.

According to a report by the Federal Reserve, nearly 40% of Americans would struggle to cover an unexpected $400 expense. This highlights the importance of wealth maximization and financial planning in today’s economy.

Key Principles of Aagmaal

Aagmaal is built on a set of key principles that guide individuals in their financial journey. These principles include:

Read also:Fry99 Xom A Comprehensive Guide To Understanding Its Features And Benefits

- Discipline: Sticking to a financial plan and avoiding impulsive decisions.

- Education: Continuously learning about financial markets and investment opportunities.

- Patience: Understanding that wealth growth takes time and perseverance.

How These Principles Work Together

By combining discipline, education, and patience, individuals can create a sustainable financial strategy that maximizes their wealth over time. These principles are the foundation of a successful aagmaal plan.

Strategies for Growing Wealth

There are several strategies for growing wealth, and aagmaal provides a framework to implement them effectively. Some of these strategies include:

- Diversification: Spreading investments across different asset classes to reduce risk.

- Compound Interest: Leveraging the power of compound interest to grow wealth exponentially.

- Real Estate Investment: Investing in real estate for long-term appreciation and rental income.

Benefits of Diversification

Diversification is a key strategy in aagmaal that helps protect your wealth from market volatility. By spreading your investments, you can minimize risk and maximize returns.

Common Mistakes to Avoid

While pursuing wealth maximization, it’s important to avoid common mistakes that can hinder your progress. Some of these mistakes include:

- Over-leveraging: Taking on too much debt to finance investments.

- Emotional Decision-Making: Making impulsive financial decisions based on emotions rather than facts.

- Ignoring Inflation: Failing to account for the impact of inflation on your financial goals.

Tools and Resources for Aagmaal

There are numerous tools and resources available to help you implement a successful aagmaal plan. These include:

- Financial Planning Software: Tools like Mint and YNAB help you track expenses and manage your budget.

- Investment Platforms: Platforms like Robinhood and Wealthfront offer easy access to investment opportunities.

- Educational Resources: Books, podcasts, and online courses provide valuable insights into financial management.

Recommended Resources

Some recommended resources for aagmaal include:

- “The Intelligent Investor” by Benjamin Graham

- “Rich Dad Poor Dad” by Robert Kiyosaki

How to Start Aagmaal

Starting aagmaal involves a few key steps:

- Assess Your Current Financial Situation: Evaluate your income, expenses, and net worth.

- Set Financial Goals: Define short-term and long-term financial objectives.

- Create a Financial Plan: Develop a plan to achieve your goals, incorporating savings, investments, and debt management.

Creating a Financial Plan

A well-structured financial plan is essential for successful aagmaal. It should include specific, measurable, achievable, relevant, and time-bound (SMART) goals.

Measuring Success in Aagmaal

Measuring success in aagmaal involves tracking key performance indicators (KPIs) such as:

- Net Worth Growth: Monitoring the increase in your overall net worth over time.

- Investment Returns: Evaluating the performance of your investment portfolio.

- Debt Reduction: Tracking progress in reducing and eliminating debt.

Setting Benchmarks

Setting benchmarks helps you stay on track and measure your progress towards financial goals. Regularly reviewing these benchmarks ensures that you’re making the necessary adjustments to your aagmaal plan.

Expert Advice for Aagmaal

Seeking expert advice is an important part of a successful aagmaal strategy. Financial advisors and experts can provide valuable insights and guidance to help you navigate complex financial decisions.

Choosing the Right Advisor

When choosing a financial advisor, consider their credentials, experience, and track record. Look for advisors who are certified and have a proven history of success in wealth management.

Conclusion

Aagmaal is a comprehensive approach to understanding and maximizing wealth. By following the principles and strategies outlined in this guide, you can create a solid foundation for financial success. Remember to stay disciplined, educated, and patient in your financial journey.

Take action today by implementing the tips and strategies discussed in this article. Share your thoughts and experiences in the comments below, and don’t forget to explore other articles on our site for more insights into wealth management and financial planning.